Digital Estate Planning Tools are becoming an essential part of modern financial and personal planning as more of our lives move online. From email accounts and cloud storage to cryptocurrencies, online businesses, and social media profiles, digital assets now carry real financial, emotional, and legal value. Without a clear plan in place, families often struggle to access or manage these assets after a loved one passes away. This is where digital estate planning steps in, offering a structured and secure way to protect your online legacy.

What Is Digital Estate Planning?

Digital estate planning is the process of organizing, managing, and assigning access to your digital assets in the event of death or incapacity. Unlike traditional estate planning, which focuses on physical and financial assets, digital estate planning covers online accounts, digital files, intellectual property, and even subscription services.

Digital Estate Planning Tools help simplify this process by securely storing information, documenting instructions, and ensuring your wishes are followed without unnecessary legal complications.

Why Digital Assets Require Special Planning

Many people assume their family will automatically gain access to their online accounts, but that is rarely the case. Most platforms operate under strict privacy laws and user agreements that prevent unauthorized access, even for next of kin.

Without proper planning, loved ones may face:

- Permanent loss of valuable digital files

- Locked financial or crypto accounts

- Inaccessible business tools or client data

- Ongoing subscription charges

- Emotional distress caused by unmanaged social profiles

Digital Estate Planning Tools are designed to prevent these issues by providing clear instructions and controlled access.

Types of Digital Assets You Should Include

Before choosing a tool, it is important to understand what qualifies as a digital asset. These typically include:

- Email accounts and cloud storage

- Social media profiles

- Online banking and investment platforms

- Cryptocurrency wallets and NFTs

- Digital businesses, domains, and websites

- Intellectual property and digital content

- Subscription-based services

A complete digital estate plan addresses all these areas in one organized system.

How Digital Estate Planning Tools Work

Digital Estate Planning Tools function as secure platforms where you can catalog your digital assets, assign beneficiaries, and define access rules. Some tools integrate with legal documents, while others focus on password management and secure data transfer.

Most tools follow a simple workflow:

- You list your digital assets

- You assign trusted contacts or beneficiaries

- You set access conditions

- The tool executes your instructions when triggered

This automation reduces confusion and eliminates the need for family members to guess your wishes.

Key Features to Look for in Digital Estate Planning Tools

Not all tools offer the same level of security or flexibility. When evaluating options, look for features that align with both legal requirements and practical use.

Important features include:

- Bank-grade encryption and security

- Role-based access for heirs and executors

- Integration with wills and legal documents

- Emergency access protocols

- Automatic inactivity triggers

- Secure document storage

The best Digital Estate Planning Tools balance ease of use with robust protection.

Legal Considerations and Compliance

Digital estate planning operates at the intersection of technology and law. Laws vary by jurisdiction, and not all digital assets are treated equally under estate law.

Some tools help users comply with laws such as the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), which governs how digital assets are accessed after death. Choosing a tool that supports legal compliance ensures your plan holds up if challenged.

It is often recommended to use Digital Estate Planning Tools alongside a traditional estate plan rather than as a replacement.

Benefits of Using Digital Estate Planning Tools

The advantages go beyond convenience. These tools offer peace of mind and clarity during difficult times.

Key benefits include:

- Reduced legal disputes

- Faster asset access for heirs

- Protection against data loss

- Clear execution of personal wishes

- Centralized management of digital information

For individuals with extensive online activity or digital investments, these tools are no longer optional.

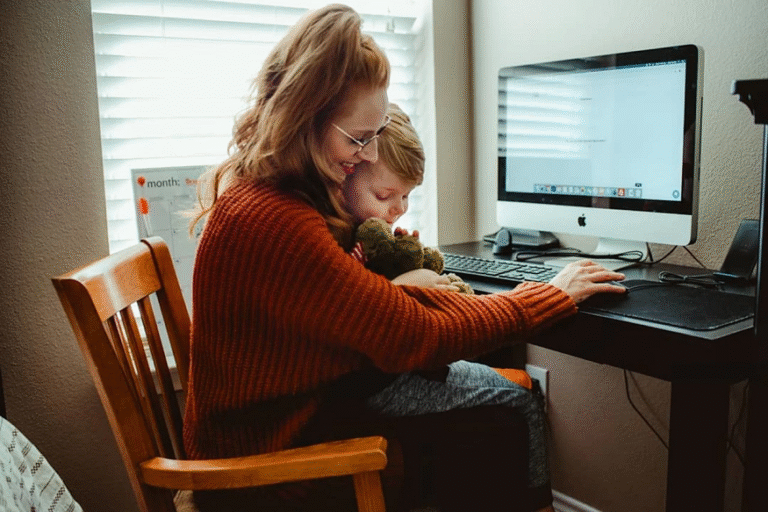

Who Should Use Digital Estate Planning Tools?

Digital estate planning is not just for high-net-worth individuals or tech professionals. Anyone with online accounts can benefit.

These tools are especially valuable for:

- Business owners managing digital operations

- Investors holding crypto or online portfolios

- Content creators and freelancers

- Families managing shared digital access

- Individuals focused on long-term legacy planning

If your digital footprint has value, planning for it is a smart move.

Common Mistakes to Avoid

Despite the availability of Digital Estate Planning Tools, many people make avoidable mistakes.

Common errors include:

- Storing passwords insecurely

- Failing to update asset lists

- Not informing executors about the plan

- Relying solely on handwritten notes

- Ignoring legal requirements

A structured digital tool helps eliminate these risks by keeping everything secure and up to date.

The Future of Digital Estate Planning

As digital ownership continues to expand, Digital Estate Planning Tools will become more advanced and more widely adopted. Features like AI-assisted asset discovery, automated compliance checks, and deeper integration with financial institutions are already emerging.

Planning today ensures you stay ahead of future complexities and protect your digital legacy effectively.

Final Thoughts

Digital Estate Planning Tools provide a practical and secure solution for managing the growing complexity of digital assets. They bring structure to an area that is often overlooked, ensuring your online presence, finances, and digital creations are handled exactly as you intend.

By taking action now, you reduce stress for your loved ones and gain confidence that your digital life is protected, organized, and future-ready.

+ There are no comments

Add yours