When our users receive a request for identity verification, our platform provides a link to upload the necessary documents. Data processed by ShuftiPro, our current identity verification partner, is stored in secure data servers under strict security measures to provide maximum data protection to our customers. For more information about our specialist partner in verifications click here .

Shufti Pro holds a variety of compliance and cybersecurity certifications, including Quality Guild (HQ) Management Standards – GDPR Compliance Certification, PCI Security Standards Council (PCI DSS) Compliance Certification, and Cyber Essentials Certification from the National Cyber Security Center (NCSC). Shufti Pro is registered with the UK Information Commissioner’s Office (ICO) under GDPR and UK DPA 2018.

It is also important to clarify that we may retain certain data for longer periods as required or permitted by any applicable law. For example, we are required to retain specific data relating to payment transactions for several years. We may also retain certain data for fraud detection purposes or for security reasons such as identities.

We may use your personally identifiable information to register you, to provide you with the services of our rental platform, to contact you in order to provide certain services or information that you have requested, to detect possible fraud or to improve the content and general administration of the site and our mobile applications. We may use your photograph, copy of your ID or passport, and/or copies of your utility bills to verify your identity.

As more and more financial services go digital, it is essential for financial institutions to offer their customers fast, reliable, mobile and online access to products and services. This often involves rethinking the customer journey, especially the stage where a customer and a financial institution first establish a relationship – on boarding and account creation.

Account opening requires mutual trust between a client and a financial institution (FI). Customers must trust the FI to keep their personal information secure and private, and in return, the FI must verify that the customer is who they say they are.

In this article, we provide an in-depth guide to one of the most powerful digital identity verification solutions for building digital trust – automated identity document verification powered by artificial intelligence (AI).

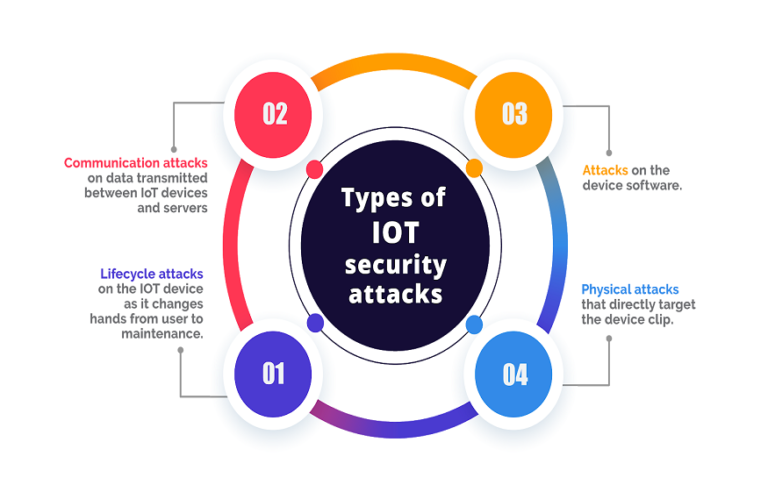

Common digital identity verification solutions

Biometric facial verification – Comparison of a selfie with an image on a validated identity document (for example, image on a driver’s license).

One-Time Password (OTP) Verification – A one-time password is passed to the applicant during the account sign-up/application process.

Knowledge-Based Authentication (KBA) – The customer is asked to answer a number of questions based on their personal information, for example based on information from credit bureaus.

To provide a fast online customer experience while building trust, the best combination of these digital identity verification methods is ID document verification and facial recognition . These technologies make it possible to digitally verify the identity of almost any potential customer using a government-issued identity document such as a driver’s license, passport, or national ID card.

The customer starts the account opening process and is asked to capture images of their identity document using their mobile phone camera (two images for driving licenses and national identity documents and an image for passports).

The captured images of the identity document are sent for verification.

The images are analyzed using artificial intelligence, data points are extracted (eg name, expiration date) and the ID is verified.

The account opening solution receives the response/result, performs a number of data matches, and decides whether or not to allow the candidate to proceed.

The account opening solution sends a notification to the applicant informing them of the decision.

The duration of this process depends on the level of document scanning configured as part of the process. Determining the level of analysis involves balancing customer experience considerations and risk.

+ There are no comments

Add yours