Alright, let’s chat about something that might not be top of mind but is oh-so-relevant—gold loans. Ever found yourself in a financial jam and just wished there was a way to make use of those family heirlooms sitting in your drawer? That’s where gold loans come striding in, like a hero from a storybook, ready to rescue you.

Gold Loans: More than Shiny Trinkets

First things first, gold loans are pretty much what they sound like. You’ve got gold, and you exchange it for a loan. Simple, right? But here’s the kicker: you don’t have to sell your precious jewelry. Instead, you use it as collateral, which means you can reclaim it once the loan is paid off. This is especially a game-changer for anyone who feels a deep sentimental connection to their gold pieces.

Enter the Era of Gold Loan Apps

Now, picture this. You’re sipping your morning coffee, glancing at your bracelet pondering its potential. It’s not just about owning gold anymore; it’s about leveraging it, and gold loan apps have revolutionized this. You used to think of applying for a loan as tedious—long queues and cumbersome paperwork. But with these apps, it’s like having a bank in your pocket. Convenient and hassle-free.

The Magic of Real-Time Monitoring

So, how do these nifty apps work? Well, here’s the thing—real-time monitoring is the showstopper. Imagine being able to track your loan details any time you want. Need to know the balance, upcoming dues, or interest rates? Just a tap away. It’s like having your own personal loan manager, sans the suit and tie.

Why is this important, you ask? It’s about empowerment. Having instant access to your loan information lets you make quick decisions. Planning to pay off early or just curious about where you stand? You’ve got the info handy. It saves time, spares you the stress, and keeps you informed.

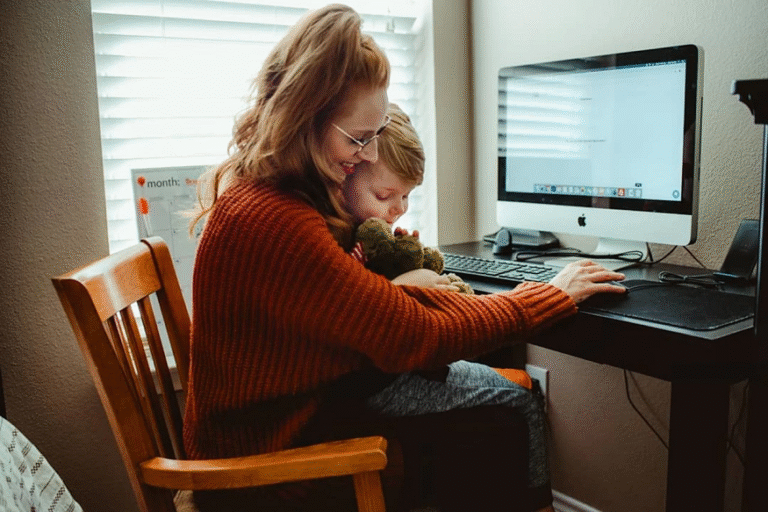

Unwrapping the App Features

These apps aren’t just about numbers—they’re about experience. They come with user-friendly dashboards that even your tech-challenged uncle could navigate. Sleek interfaces, alerts for due dates, and even support chats if you have questions. Some even let you renew your loan with a few clicks. Fancy, right?

Plus, security is airtight. Fingerprint recognition and encryption ensure that only you can access your precious details. Privacy and safety wrapped together—just like your favorite blanket on a chilly night.

A Quick Detour: Why Gold?

Let’s hit pause for a second. Why is gold such a reliable form of collateral? For one, it holds a universal, timeless appeal. Its value tends to remain stable even when everything else is on a rollercoaster ride.

In many cultures, gold is synonymous with wealth and status. It’s not just a piece of metal; it’s a narrative woven into jewelry. And when something carries such cultural weight, it’s comforting to know it can also provide financial backup.

Your Gold and Your Goals

These apps turn what could’ve been a cumbersome experience into a seamless one; you can set reminders for payments or check how market fluctuations might impact your interest. It’s all part of the plan to ensure you can focus on bigger goals while managing the smaller details efficiently. It’s like autopilot for your finances.

Wrapping Things Up

So, what’s the bottom line? Gold loan apps are not merely a fleeting trend; they’re changing how we interact with our investments. They’re about making things easy, intuitive, and accessible. They blend the comfort of tradition with the convenience of modern tech.

Next time you’re gazing at that ring or necklace, remember—you’ve got options, and they’re far more exciting than just keeping them locked away.

In a world that’s constantly evolving, it’s nice to know some things, like the significance of gold, remain steady. And with the help of these apps, you can make sure your finances do too. After all, who doesn’t love a touch of gold guiding their way?

+ There are no comments

Add yours